|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

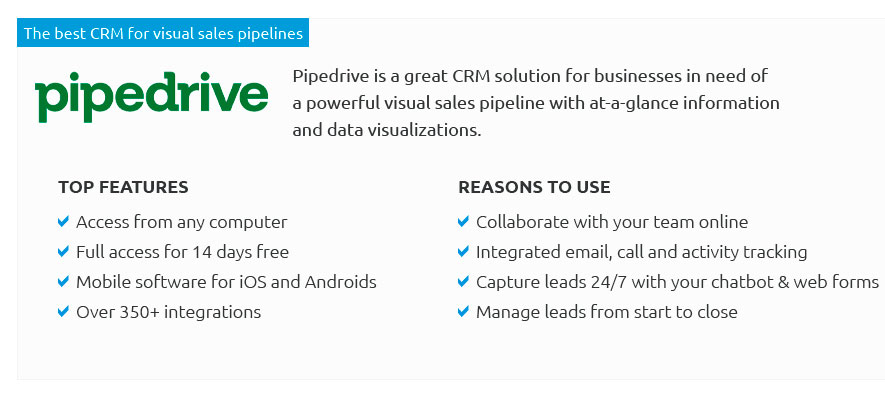

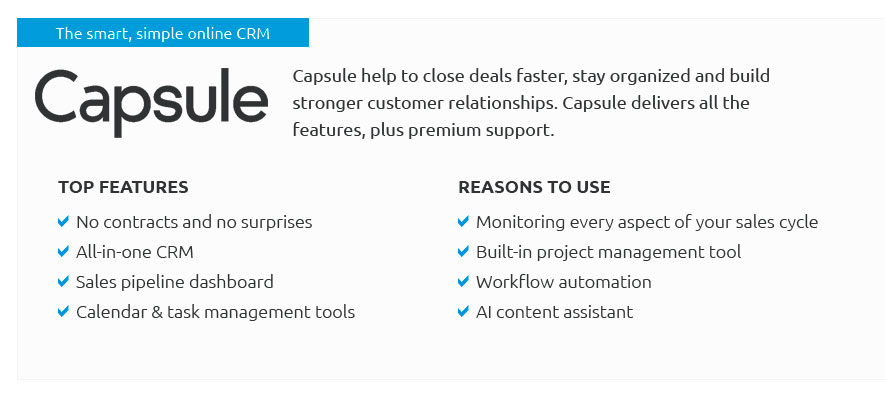

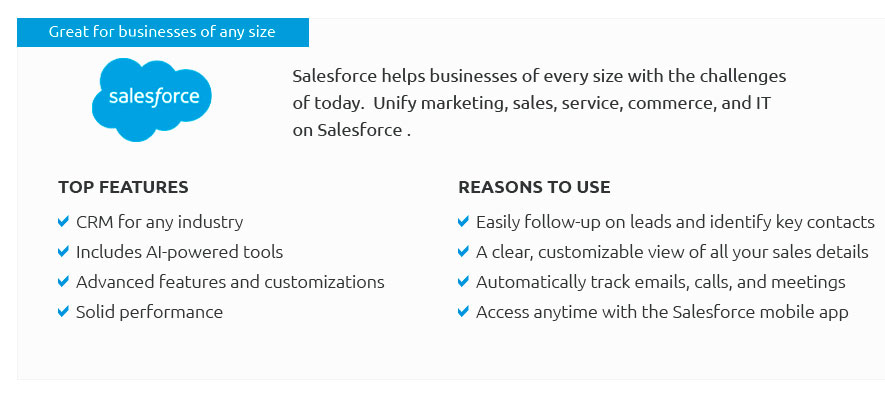

The Transformative Role of CRM in Insurance AgenciesIn today's rapidly evolving business landscape, the integration of Customer Relationship Management (CRM) systems within insurance agencies has become not merely beneficial, but essential. With a robust CRM platform, agencies can streamline their operations, enhance customer satisfaction, and ultimately drive growth. The significance of CRM systems cannot be overstated as they offer a comprehensive solution to many challenges faced by the industry. Understanding CRM in the Insurance Sector CRM, at its core, is designed to manage a company's interactions with current and potential customers. For insurance agencies, this means a tailored approach to managing client data, policy renewals, and claims processing. CRM systems provide a centralized database where all customer interactions are stored, allowing agents to access vital information at their fingertips. This is crucial in the insurance industry, where personalized service and timely responses can significantly impact customer retention rates. Benefits of Implementing CRM Systems

It's important to recognize that the implementation of a CRM system is not a one-size-fits-all solution. Agencies must carefully consider their unique needs, budget constraints, and existing technological infrastructure when selecting a CRM platform. Investing in training and support is also crucial to ensure that staff can fully utilize the system's capabilities. The transition to a CRM-based operation may require an initial investment of time and resources, but the long-term benefits far outweigh these costs. In conclusion, a well-implemented CRM system can be a game-changer for insurance agencies, providing them with the tools necessary to stay competitive in an ever-changing market. By enhancing customer experiences, improving efficiency, and offering valuable insights, CRM systems empower agencies to see the bigger picture and make informed decisions that drive success. https://www.reddit.com/r/CRM/comments/1cec8fn/crm_for_insurance_agents/

Hope you have found the right solution by now! In case you are still exploring, it is worth considering Damco' InsureCRM. it is affordable, and ... https://www.hubspot.com/products/crm/insurance

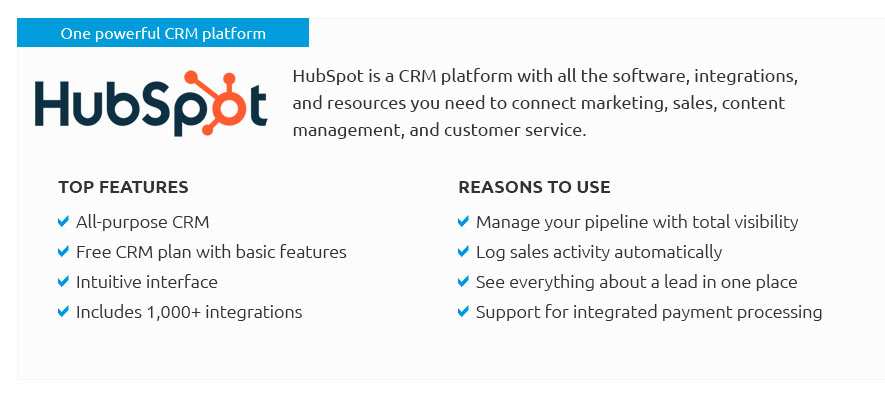

HubSpot CRM offers forever-free plans for its Sales, Marketing, and Service Hubs. As your insurance agency grows, you can upgrade to a premium version with more ... https://www.insuredmine.com/

The Ultimate CRM for Insurance Agents. Welcome to InsuredMine! Your go-to platform for insurance agencies, offering easy-to-use software solutions to manage ...

|